About Us |

Management Team |

Accredited Investor |

Our Events |

PASSIVE INCOME THROUGH CASH-FLOWING NOTES

|

How Do Banks Make Money?

Banks are businesses; they have an obligation to make money. There are three main ways: charging interest on money it lends, charging fees for retail services, and trading financial instruments in various markets. Commercial and retail banks raise funds by lending money at higher interest than the rate paid on deposited funds. |

|

Be The Bank Yourself!

Instead of depositing your money in the bank and getting back pennies in return, you have an opportunity to become a bank yourself and earn double-digit interest rates. Real Estate motgage note investing is a superior alternative for getting a better return! Paper Assets Capital is a fund management organization that works with individuals, groups, hedge funds, family offices and/or retirement funds. It produces a predictable income stream from cash-flowing notes. The Mortgage Lien provides security, protection and recourse. By becoming a Capital partner in the Offering, you provide a Private Funds and become a passive investor. PAC's fund acquires assets, then applies its expertise to create value and generate revenue. You receive preferred double-digit return on your capital with no effort. |

We'd like to show you how you can invest in paper assets secured by Real Estate

where 5% to 9% returns are not out of the ordinary.

How to get started!

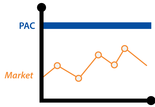

WHY ARE TRADITIONAL INVESTMENTS NO LONGER INTERESTING ?

A comprehensive wealth-building strategy will always incorporate investments, and many people stick with traditional means of investing such as mutual funds, CDs, stocks, bonds, or ETFs.

The problem with these investments is that the rate of return is marginal at best, and there is no built-in safety net. When investing in so-called "safe" investments such as mutual funds, you give up all control and pay fund managers a premium to manage a portfolio. None of these investments provide enough returns to a quicker, safer way to grow your net worth.

Contact us today to learn more about alternative investing.

The problem with these investments is that the rate of return is marginal at best, and there is no built-in safety net. When investing in so-called "safe" investments such as mutual funds, you give up all control and pay fund managers a premium to manage a portfolio. None of these investments provide enough returns to a quicker, safer way to grow your net worth.

Contact us today to learn more about alternative investing.

HAVE YOU CONSIDERED BECOMING A PASSIVE INVESTOR ?

If you are looking to buy single or multy-family piece of real eastate and/or perhaps own one already would it make sense to become the Lien-Lord instead and avoid traditional Landlord issues like -Tenants, Toilets, Trash, and Termites.

Fund investing is a way to use the equity in your home, your self-directed IRA, 401(k), or even cash to finance the purchase of units that are backed by real estate. The difference between investing in a equity fund and more traditional options is that you receive higher then average market rate of return, and a real asset secures your investment.

Fund investing is a way to use the equity in your home, your self-directed IRA, 401(k), or even cash to finance the purchase of units that are backed by real estate. The difference between investing in a equity fund and more traditional options is that you receive higher then average market rate of return, and a real asset secures your investment.

FUNDING SOURCES and OPTIONS

Some people prefer to use readily available cash, matured CD or bonds as well as taking an equity line of credit from their real estate at 4% and invest in PAC's Offering at 9% and enjoy the 5% difference as a long term cash-flow strategy. Others prefer using self-directed retirement accounts to take advantage of a tax-sheltered environment, in which case all income goes back to your retirement account tax defered or tax free (please consult with your tax professional).

ROI SNAPSHOT

TRADITIONAL BANKING vs PRIVATE EQUITY FUND

At Paper Assets Capital our Goal is to Outperform Market Returns

UNLOCK YOUR RETIREMENT ACCOUNT

|

You might be surprised to find out just how many different types of retirement accounts allow for Equity Fund Investing. Some of them include:

Keep in mind, this is not intended to be a comprehensive list. It is always a good idea to speak with the manager or custodian of your existing retirement account to determine whether or not your account is set up to handle self-directed investments. It is also important that you speak with the custodian to determine what, if any, fees may be involved with money moving in and out of any retirement account. |

SOCIAL RESPONSIBILITY

|

Paper Assets Capital provides life-changing financial resolutions for families and creates positive stabilization for communities. Having bought distressed notes, we strive to create workable solutions with homeowners who find themselves in a financial predicament, but wish to stay in their homes. Assessing their current situation, we can help them get ‘back on track’ with several work out solutions and exit strategies.

|

HELP AMERICANS SAVE THEIR HOMES - ONE HOUSE AT THE TIME!

NEXT STEP!

|